THE CASE OF THE MYSTERIOUS M. CARRAU

Jean Carrau is a true mystery of the art world. He wasn’t a blip on the art scene radars, until his paintings started turn up about 10 years ago in auction houses, galleries and museums in the US and Europe.

This much is known: His works focus on a girl (“Suzie” or “Fifi”) and her boyfriend, a handsome young mariner (always in a sporty sailor’s outfit). They have a cat named Fredy (yes, with only one “d”), and a pug dog named Toto, as well as a bird in an ornate cage.

Sometimes the subjects get adventurous: they enjoy riding in the gondola of a dirigible or a visiting to the wild animals in the zoo.

Courtesy of Martin Art NY

Currau’s world exists in a setting akin to the Belle Epoque – that period between 1890 and 1910 when it seemed everyone enjoyed simple pleasures. There are no computers nor cell phones nor jets in the sky, and everyone seems to wear a winsome smile. Even the fish that will soon be eaten wears a look of bemusement.

Oddly enough although there is presumably sex between the characters, they maintain a distinctly odd modesty. Fifi/Suzie masks her most appealing private parts thanks to the use of a strategically deployed black bow tie.

Modesty extends to the painter. An extensive search yielded no photo of the artist. Indeed, no one seems to know much at all about the elusive M. Carrau. In auction catalogues his birth ranges from “?” to 1920, 1923, or 1925. The last three birth dates are very problematic, since several of Carrau’s mature works are both signed and dated in 1927 or 1929. However, he lived a full life until he died in 1986… or was it 1996?

Even art experts seem unable to nail down the facts. askART, a compendium of information on artists and the art world was dumbfounded and perplexed. The editors appear to have been stumped. “No biographical write-up is currently available for this artist,” was the most they would say. ArtNet confined Jean Carrau to a biography of precisely three words: “French, died 1996”

Of course this could be a joke being played on galleries, auction houses and their patrons. This is not the first time for such a ruse. The Paris art scene in the 1920s was treated to the inane adventures of Pere Ubu, created by a group of surrealists, and even Marcel Duchamp could develop his ‘feminine’ side as Rose Selavy (“c’est la vie” geddit?).

Meanwhile the works of Jean Carrau continue to come on the art market, to entertain and amuse collectors of an artist who, in reality, probably never actually existed. What would Rose Selavy say?

- Josh Martin

AN ART COLLECTOR TELLS:

HOW TO GROW A BODY OF ART

By ‘Theophylact Duveen’

I am living proof that you don’t have to be a billionaire to amass an enviable art collection.

I began my quest soon after I graduated from college, and continued collecting over half a century since then...

My apartment now boasts over 150 works of art on walls, on shelves, or (in the case of sculptures) free standing on tables and floor space.

It has been a labor of love. My collection includes great examples of 19th- , 20th - and 21st - century artwork.

Courtesy of Martin Art NY

The list of artists represented includes signed originals or limited edition prints by masters such as Picasso, Miro, Renoir, Alice Neel, George Grosz, Thomas Hart Benton, John Sloane, Red Grooms, David Hockney, Louise Kruger, William King, Antonio Grediaga Kieff, Chaim Grosz, Tony Smith (UK), Jacob Lawrence, Abraham Walkowitz, Sol LeWitt, Brice Marden, Robert Rauschenberg, Man Ray, Jacques Lipschitz, Ramiro Saus, Scott Cousins, Turgaz, Lois Dodd, Henry Moore, Pedro Roth, Andres Muller, Joan Arp, Sonia Delaunay, George Symons, Fairfield Porter, Karl Appel, Raoul Dufy, Jean Cocteau, Giorgio De Chirico, Allan D’Arcangelo, Herman Rose, Chuck Close and many more.

What were my rules of collecting?

First of all, to only collect artworks that I liked. In addition to the named artists above, I acquired many artworks with no known creator. The energy or wit of an anonymous creation can be refreshing and startling. I have never purchased a work of art simply because the artist is “famous” or in vogue.

Second, keep art purchases in affordable amounts. With artists and galleries I always negotiate the price. With auctions the price of a given artist can be less expensive than an identical work for sale in a gallery.

Third, make sure I have storage space to hold works that have yet to be put on display.

Last but not least to carefully document purchases should I decide to sell off works to change the focus of my collection. Getting provenance from most dealers and auction houses can be a challenge, despite the growing importance to determine if the artwork is original and without questionable prior ownership.

There are some artists who I refuse to buy because of such questions. Two examples on my negative list are Salvador Dali (rumor has it that he was in cahoots with unsavory characters who made ersatz Dali artworks and had Dali simply affix his signature) and Rene Magritte (whose wife Georgette sold many Magritte works after his death by stamping his signature and affixing her own).

I also avoid purchasing knowingly stolen works, such as Southeast Asian religious statuary or Greek Orthodox icons. However, I have been given or inherited works from Incan, Inuit or African tribal origins.

ARTISTS MAY BEAR BRUNT

OF ART MARKET SLUMP

Virtually all major galleries and auction houses in New York are reeling from the decline of collectors willing to invest their money in art. In the past year, sales have declined over 20% overall. But the big impact of the slump has occurred at the same time public funding of fine art has meant that current budgets have been sharply cut. Reduced federal and state funding that has hurt art museums as well as those programs which provide grants to artists to tide them over in the present lean times.

Ironically, the slump could compel many planning to devote their time to making art, creating a shortage of new works being created. In other words, this could result in a sharp reduction in the supply of new art.

The art market could revive, with those creators who survived funding shortages reaping benefits. After all, this would be a reflection of the classic result of little supply (of artists) chasing more demand (for artworks).

According to the recently published Art Basel and UBS Art Market Report, spending on art in the US fell 20%. But there are some interesting data points: A survey of 3,660 art buyers revealed that most respondents preferred to buy from a dealer, but when doing so, just over half (52%) preferred buying via their websites or social media channels and without viewing the work in person.

The Art Basel/UBS report also revealed that there is a direct correlation between the price of an artwork and the venue selected. For artworks of $50,000 or less, 62% were completed online, whereas 51% of artworks priced at $1 million or more were completed offline. This will not affect the fact that states routinely apply sales tax on art sales, whether at auction or through a dealer.

There is concern among American buyers that the Trump administration might eliminate the ‘carried interest loophole’ which allowed favorable tax treatment of certain compensation received by private equity, venture capital, and hedge-fund managers, which some in the art trade feared might affect collectors and donors.

Some art buyers and dealers fear that there might well be new tariffs on luxury items, including high-value collectibles and artworks, especially on imports from countries with significant trade surpluses with the US.

Although the US does not presently apply tariffs on imported art from Europe, the Trump administration has put tariffs on Chinese art imported into the US.

On the plus side, this may give American artists more advantages in a relatively weak market.

-Josh Martin

ART MARKET TURMOIL AHEAD

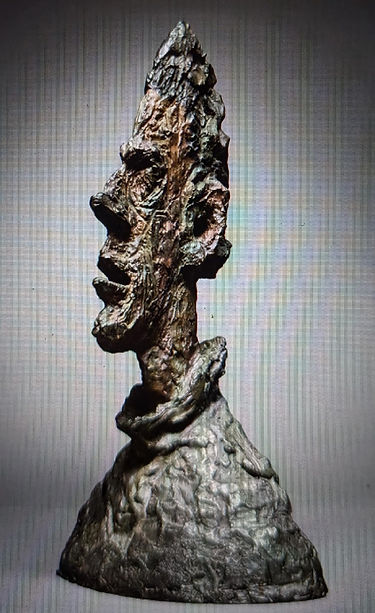

Earlier this year, a major art collection decided it would be a good time to sell a unique work by the Italian sculptor, Alberto Giacometti. The unique bronze work, a portrait of the artist’s brother, Diego, was put up for sale at Sotheby’s, the world’s premier auction house, with the hammer price expected to reach or exceed $70 million.

Alas, things didn’t go as planned. The auction house started the bidding at $59 million. But no one in the room or on the phones was making any bid. In the end the Giacometti masterpiece, entitled Grande Tete Mince, didn’t sell.

The Art Newspaper, mimicking the famous Variety headline reporting the stock market crash of 1929 (“Wall Street Lays an Egg”), reported the Giacometti “bombs at patchy Sotheby’s Modern art auction”

The same auction included works by Picasso, Fernand Leger, Jean Arp, Alexander Calder and Magritte. But no records were set. The Sotheby’s auction, held on May 13, sent a clear message that wealthy art collectors were holding onto their cash, in anticipation of an economic downturn later this year.

Giacometti masterpiece, entitled Grande Tete Mince

The auction sent a shock through the New York art markets. At the same sale, works by several other major artists failed to sell, including works by Matisse, Picasso, Degas, David Smith and Andrew Wyeth.

The New York gallery scene has also taken a hit over the spring and summer. In a visit to several Chelsea galleries in June and July, one could see that many shows had only a handful of buyers.

While this may indicate a lean fall and winter for artists, galleries and auction houses, it can present opportunities for collectors who can afford to add to their collections. Many galleries and artists are willing to accept price cuts that can range up to 30% or more.

For living artists there are still several institutions which offer art-specific support. These include New York based providers of art materials, pro bono legal help, and foundation and non-profit research bureaus. See the articles below which provide descriptions and contact information.

-Josh Martin

FUNDING YOUR ART

As every artist knows, the creative process often depends on finding a sponsor or a donor to bring artwork into existence. There is no free lunch!

So where do you get the funding you need? Luckily, New York City is home to research facilities to help you find the foundations and other donors who can lubricate your creative impulses.

The best organization to turn to is aptly named The Foundation Center. It maintains the most comprehensive database on U.S. grantmakers and their grants. It also operates research, education, and training programs designed to advance philanthropy at every level.

The Foundation Center is located in the Financial District at 32 Old Slip, 24th Floor New York, NY 10005. The phone number is 212-620-4230.

One of the major services it provides is guidance on how to submit an application for a grant.

The Foundation Center offers courses on how to write a grant, how your proposal should be presented, and how to select the foundation or award program most closely aligned with your artwork. Some donors like the Ford

MacArthur Foundation are well funded but can often have unique requirements to be considered for a grant. Other philanthropic entities offer small awards, which might be all you need to finish a project.

The Foundation Center library offers a wide range of information resources, to enable to find the foundation that is most compatible with your project.

Contact the Foundation Center to take a free tour of their facility and attend their introduction to funding grants and foundation research.

Money might not grow on trees, but it can be found through the Foundation Center’s unique information resources!

GETTING LEGAL HELP

Suppose someone buys your artwork, but fails to make the payment. Or what if a framer damages your artwork? You may need the services provided by the Voluntary Lawyers for the Arts.

The VLA, created by members of the New York City Bar, provides a broad range of services at little or no cost.

The VLA strives to protect the artistic community’s livelihoods, businesses, and creative works through access to dedicated legal representation and focused education programs.

Want more information? You can visit their website here: www.vlany.org. While the VLA does not accept walk-ins, artists can get help by writing the organization at valny@valny.org. Or you can call the VLA at 212-319-2787.

You might also want to take advantage of their extensive educational programs designed to help artists as well as arts and cultural institutions. Classes are currently being held online through Zoom. More information is available on the VLA website.

PICASSO SHOWS GIVE NEW YORKERS

CHANCE TO SEE LONG HIDDEN WORKS

The Picasso family has lent a dazzling selection of the masters works for two shows in New York City, offering an opportunity to view art that has rarely if ever been seen in public spaces.

Interestingly, the two galleries selected by the family are less than three blocks apart. Both galleries have had a long relationship with the Picasso family. Yet there are subtle differences between how the two venues present the master’s work.

The larger show, “Picasso: Tete a tete” at Gagosian Gallery (located at 980 Madison Avenue, running through July 3) spreads through three large show rooms on two floors. It was largely organized by Picasso’s daughter Paloma, who has emerged as the mover and shaker of the huge Picasso estate.

Works in the exhibition are grouped by themes and forms. Paloma told reporters that th aim was to show Picasso’s work “as he wanted it to be seen—in conversation across subjects and periods.” Paloma adds coyly that “a number of the works we selected haven’t been seen since my father had them in his studio.”

Sadly, security precautions have dampened the mood of this show. But Picasso’s work is riveting.

Three blocks away, a subtly different show is more discrete and in its way more inviting. “Pablo Picasso: Still Life” at Almine Rech (39 East 78th Street, running through July 18) ir a much more discrete and inviting space. Like Gagosian, Almine Rech has strong ties to the Picasso family. The gallery head, Almine Rech, is married to Bernard Ruiz-Picasso, one of Picasso’s grandsons.

Ms Rech points out that the theme of this show focuses on the domestic environment in which Picasso lived and created his art. She points out that whereas other Picasso shows have often focused n his women, Almine and her husband “wanted to show the everyday objects he lived with.”

Regardless of which show you favor, the combination of these two exhibitions are a stunning reminder of what made Picasso one of if not THE greatest artists of the 20th century.

Josh Martin

Adventures in ArtLand: Where is the Provenance?

Before you cut a big check for an original work by Picasso, Monet, Magritte or Arp, you might want to ask the art dealer to let you know how a given piece of art travelled from the creator’s studio to you.

Eighty years after World War II, it is estimated that roughly 20% of all artwork in Europe was looted by Nazis, and may still be subject to restitution to the original owners. There are still approximately 30,000 works of art that are discretely held in major public and private collections whose original owners (or their living descendants) would like to have them back.

Not all journeys a work of art takes involves a journey into the seamy corners of the art market. Knowing where an artwork travelled from the date of its creation can add to its mystique.

Although galleries, museums and auction houses have made efforts to provide more information about how artworks have come onto the market, some descriptions are laughable.

Some auctions use coy language to identify the previous owner(s). Phrases can include a phrase like “owned by a former diplomat on the upper east side (of Manhattan)” or owned by an elderly couple on the North Shore (a posh area of Long Island). Others might say, “previously owned by a major sports figure.”

Personally I look forward to a sale in which at least one of the items is listed as “originally owned by a cultured German General who has been living in Argentina since 1945.”

Adventures in ArtLand:

The Signature in Question

Here is a story for all you art detectives to consider.

I recently purchased a lithograph created by the late, great surrealist artist, Man Ray. It was acquired through a major New York-based auction house.

It is known by two names, in part because the work I purchased was created in 1970, but I knew it was in fact a re-issuing of a work created in 1962. The two works are known by two different titles. The original 1962 issue carried the French title, “Nature Mort” (Still Life). The later issue was known by the English title, “Coffee Pot, Cup and Saucer”.

Many artists before and after Man Ray are known to retain a specialized publisher to re-issue popular works which can provide an artist with needed additional income in their latter years.

Indeed, Man Ray is known to have contracted with a Paris-based publisher in 1963 to undertake this task, to which Man Ray could simply affix his signature. The print run of the 1970 edition produced 175 numbered and signed copies, the same number as was the case with the original print run. An additional handful of copies on the latter run were labeled E.A.(epreuve d’artiste), the French term for "artist's proof," which designates that the print was designated as one reserved for the artist's personal use or for record-keeping, often held as a higher-value print.

But herein lies a tantalizing mystery. My work has the “E.A.” designation, yet it went for significantly a lower price than numbered copies on the market. I then noticed that the second (1970) lithograph I bought has a signature that was noticeably different from the first (1962) run. I was aware that Man Ray’s signature remained amazingly consistent throughout his 60-year career. As with other famous artists like Miro and Picasso, iconic signatures are a quick way to verify if a work is genuine.

I have no doubt that the lithograph is genuine. But it is surprising that the signature on the work published in 1970 should be so different from the original issue whose signature is consistent with Man Ray’s iconic signature. (See box below.) One is left to speculate: It is possible that Man Ray’s signature changed significantly as he grew older (from 72 in 1962 to 80 years in 1970). Or, he could have been in a rush to sign the work. Or the other – and more disturbing – possibility is that an unsigned 1970 lithograph was signed illegally.

The work now hangs in my apartment. I will enjoy asking friends to offer their explanation of the signature in question. Let me know what you think!

-- Josh Martin

Spot the differences

1962 signature

1970 signature

ART MARKET SEES TOP END PRICE SLUMP

GEN Z BUYERS PROMT SHIFT IN DEMAND

New York galleries and auction houses are watching sales in the First Quarter of 2025 to determine how to position themselves following the slump in prices in 2024.

Auction sales in the first six months at Christie’s, Sotheby’s, Phillips and Bonhams fell 26% from 2023 and 36% from the market peak in 2021, according to The Art Basel and UBS 2024 Survey of Global Collecting.

Nevertheless, according to that survey, the vast majority (91%) of wealthy collectors were “optimistic” about the global art market’s performance over the next six months, up from 77% at the end of 2023.

Familiar names still dominate the high end of the international art market. A survey of top sellers over the past five years shows that six names have came up in each year since 2019, including Andy Warhol, Banksy, Damien Hirst, Yayoi Kusama, David Hockney and Alex Katz.

(See graphic at right)

Source: Artsy

A more promising finding is that just over half (52%) of expenditure by high net worth individuals in 2023 and 2024 was on works by new and emerging artists.

This suggests that galleries with a younger stable of artists may see better bottom line results in 2025 than those galleries who represent older, more established artists.

This year may also see a continued, growing interest in works by female artists.

Artsy, a major on-line sales platform, found there was a 29% increase in inquiries from buyers for works by women artists in 2024. (See graphic at left)

Source: Artsy

Art market experts point out that galleries and auction houses will need to show an ability to adapt to such new demands from younger buyers.

Some key players are taking this to heart.

On January 3 of this year Nicholas D. Lowry, President of Swann Galleries, made a telling observation about market conditions in his annual letter to clients of the auction house: “Technology marches forward,” he wrote, adding, “administrations change, and nobody is quite sure what 2025 will hold.”

-- Josh Martin

Scott Cousins Major Painting

ACQUIRED BY THE MARTIN ART TRUST

Orfeo & Sizzy

The Martin Art Trust has acquired a major work by Scott Cousins, ‘Orfeo & Sizzy’, which has been installed in the New York office of the Trust.

The work, an oil painting on linen created in 2018. It measures 4 feet in diameter.

The work exquisitely references two major Greek mythological characters, Orpheus and Sisyphus. The two characters are often seen as near opposites. Where Sisyphus tells the story of liberty lost, Orpheus is a god of freedom. Orpheus was also known as a much loved poet and musician, who accompanied Jason and the Argonauts on some of their fabled journeys. Sisyphus was a mythic king who founded the port of Corinth, but he was also known for his avarice and deceit. He even tricked the gods in an attempt to avoid death.

Using lovely shades of lavender, Cousins’ painting suggests the two characters exist in a complex symbiotic balance.

NY Celebrates Start of Art Season

In three separate, massive venues, the New York art scene launched the start of the fall season. The first show, Art on Paper held a four-day celebration at its hipster-esque location on the lower east side of Manhattan, a stone’s throw from the city’s financial district.

The second art fair, Volta, opened on Chelsea Industrial, a showspace on west 28th street, in the heart of the vibrant Chelsea art gallery scene.

The third – and largest – art fair, The Armory Show, opened in the gigantic Javits Convention Center, locates on a site just north of Chelsea, overlooking the Hudson River.

Art Scene Summer Report

This has been an unusual summer for New York City’s fine arts market. Normally, galleries, auction houses and private dealers plan to escape the heat and humidity out on Cape Cod or up in the Adirondaks, soaking up the sunshine between sips of chilled wine and gourmet snacks. But this time, the fancy shops sprinkled through Soho, Chelsea and the Silk Stocking District, home to the classiest establishments where the well heeled could obtain the objets which cement their claim to to cultural superiority found staffs of many of the major institutions at their post, open for business to trade their wares for as much cash as you could spend.

ART MUTUAL FUNDS TEMPT INVESTORS

A new breed of investment vehicles is offering art afficianados a way to put their portfolios where their heart is, by investing in fine art.

According to Motley Fool, these funds capitalize on the fact that the value of fine art has proven to beat the performance of many stocks on the New York Stock Exchange as well as such popular investment barometers as the S&P 500 and the Wilshire 5000.

There are now a dozen art-based mutual funds where investors can put their money to work.

ART NFTS AND CRYPTO CURRENCY:

IS THERE LIFE AFTER TECHNO DEATH?

A few years ago, the art market was rocked by the emergence of a marriage of cryptocurrencies and fine art. Some seemingly banal works were going for millions of dollars, and thousands of artists joined in the frenzy, which momentarily promised to become a internet market space where the traditional control exercised by galleries and high powered art dealers was about to be overthrown.

FULL TEXT HERE

ARTISTS MIGHT STARVE

BUT ART MARKET SOARS

American artists are at the heart of a vast culture market that generates billions of dollars in foreign and domestic revenues.

According to the US Bureau of Economic Analysis GDP for the arts and culture nonprofit and commercial sector now tops $1.102 trillion with over 5.2 million jobs.

WANT YOUR OWN ART COLLECTION?

HERE’S A NY BUYERS GUIDE

If you want to build an art collection, you have many ways to find and buy the works you want. And you don’t need to be a billionaire to succeed.

FULL TEXT HERE

ARTISTS FACE COMPLEX CHOICES

TO MARKET THEIR ART

Art galleries, art sale web sites, personal web sites, auctions and crypto currency markets -- Artists in the 21st century have a dazzling choice of markets to offer their creative efforts to a buying public.

FULL TEXT HERE

COMING SOON: MORE NEWS AND FEATURES

This page will include reviews of shows, reporting on trends in the arts, and commentary on changes in how the business of art is carried out.